Driving Fact-Based ERP Harmonisation After a Major Acquisition

About this Project

- Client: A global manufacturer of power solutions, integrating systems after a major acquisition.

- Industry: Power Solutions

- Focus Area: ERP Consolidation During Acquisition

The Challenge

A global leader in power solutions, faced a significant integration challenge following its acquisition of a UK-based manufacturing subsidiary

Leadership needed clarity on key questions:

- Are local teams executing HQ’s standardised process, or are deviations common?

- Which countries demonstrate higher efficiency, and what are they doing differently?

- Where do compliance risks, inefficiencies, and bottlenecks remain hidden?

- How can best practices be identified, validated, and scaled company-wide?

Without a data-driven, objective view into these processes, our client risked inefficiency, inconsistent compliance, and missed opportunities for collaboration across borders.

Why FUTUROOT?

Traditional consulting methods for ERP harmonization — workshops, interviews, and assumption-driven modelling — were too slow and subjective. The client required fact-based, system-level insights directly from their systems to make a confident decision.

FUTUROOT delivered exactly that — a system-agnostic process mining approach, using real event logs from both Oracle NetSuite and SAP. This enabled them to:

- Processes that had quietly drifted far from SAP best pract

- Approval layers and manual steps that dragged down cycle times.

- Redundancies that added cost without adding value.

For the first time, the team had a shared fact base. Debates stopped revolving around opinions and started focusing on evidence. That shift in perspective became the anchor for their migration strategy — pragmatic, data-driven, and built on truth.

Our Approach:

Using FUTUROOT’s advanced toolset, the client gained a transparent understanding of their ERP landscape:

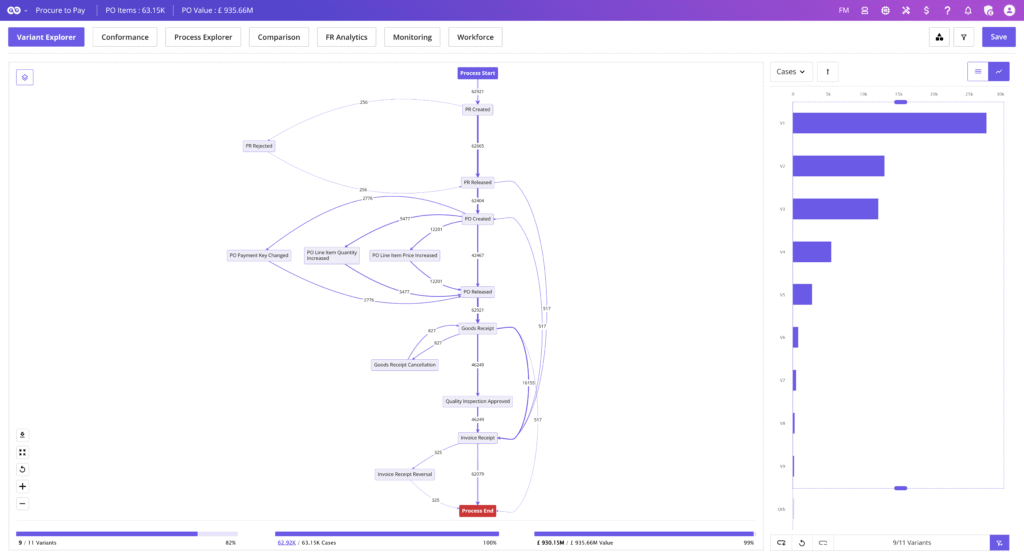

Variant Explorer

All process variations across both ERP systems were mapped, revealing differences in how identical processes—like P2P were executed between the US (Oracle) and the UK (SAP). This enabled clear comparison and filtering by system, geography, and business unit.

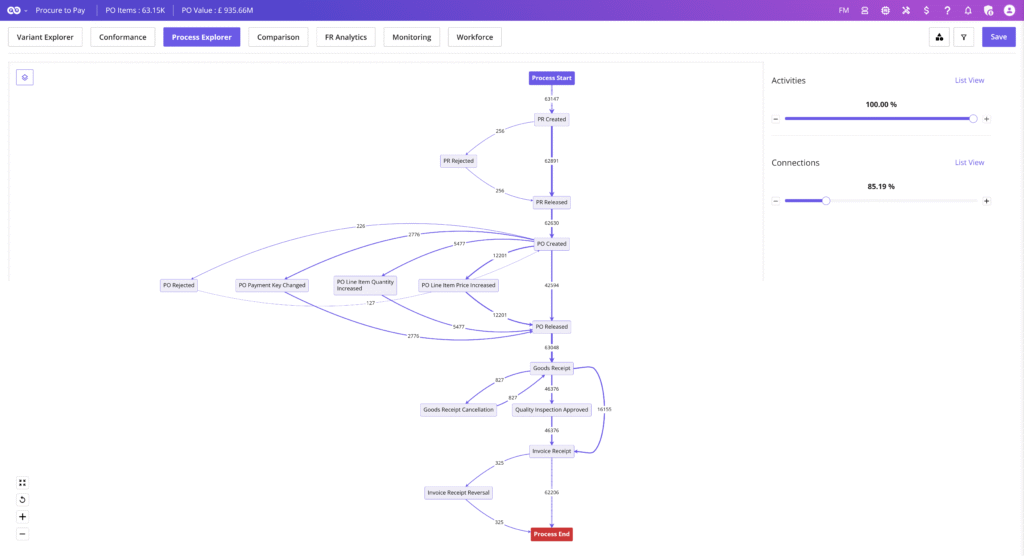

Process Comparison

We conducted a side-by-side comparison of Oracle and SAP process flows, highlighting key differences such as approval hierarchies, invoice-processing steps, and cycle times.

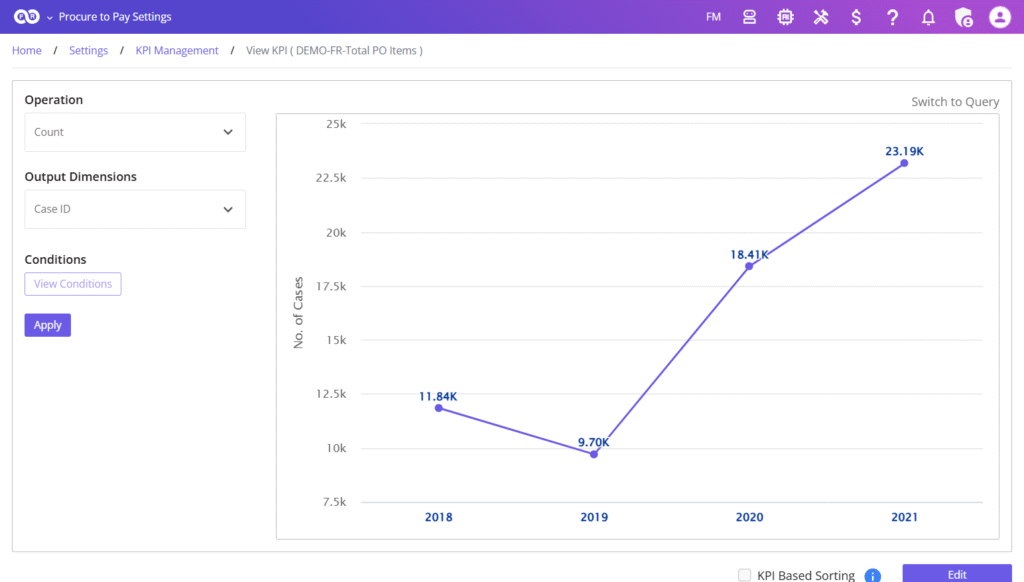

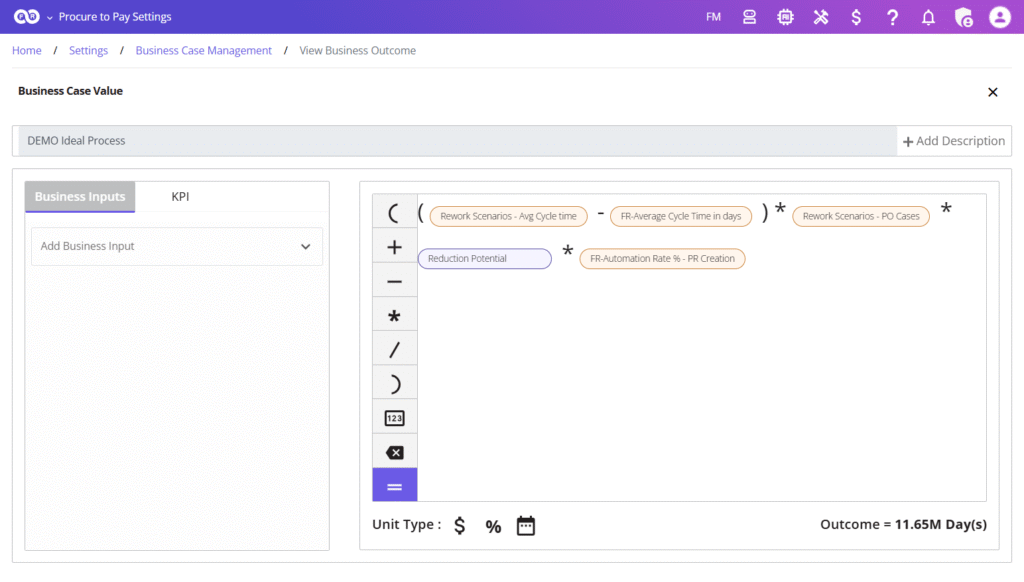

KPI Management

We established measurable success metrics for consolidation—such as invoice processing times, order-to-cash cycle efficiency, automation levels, and error rates—and quantified both current inefficiencies and future improvement potential.

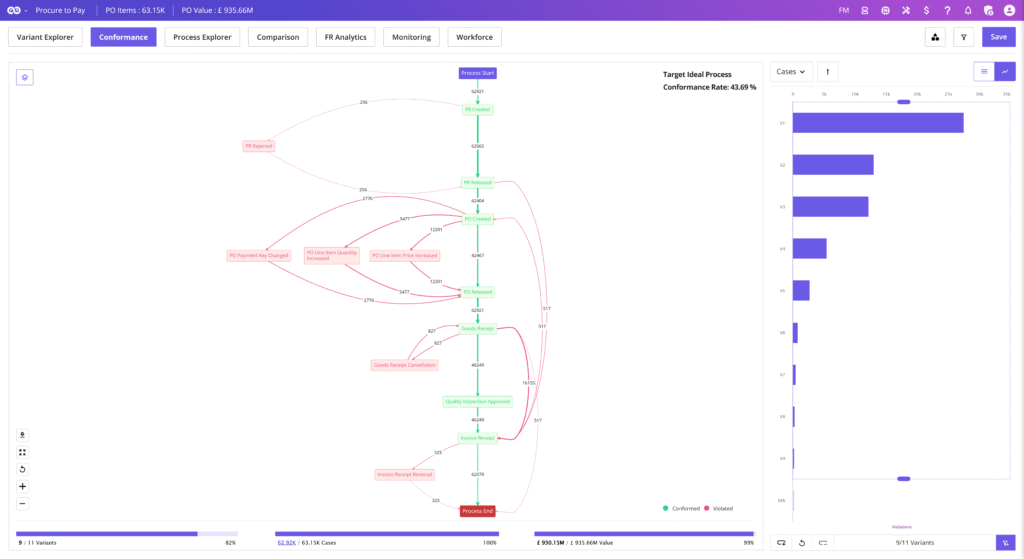

Conformance Checking

We benchmarked both ERPs against defined target rules, flagging missing activities, duplicated handoffs, and redundant workflows in real time, while also identifying valuable practices from SAP that should be preserved post-merger.

Business Case Management

We integrated the findings into a comprehensive roadmap that outlined harmonisation scenarios, quantified cost savings, and defined ROI, delivering a fact-based recommendation backed by data rather than opinion.

Business Outcomes Delivered

FUTUROOT transformed what could have been a prolonged, high-risk guesswork exercise into a rapid, evidence-backed strategic decision:

Reduction in Projected ERP Migration Effort

This equated to an estimated £500K program cost saving.

Cross-System Process Mismatches Identified

Which were all able to then be resolved before blueprinting.

Finance and Procurement Workflows Mapped

As common across ERP systems, driving faster harmonization.

Reduction in

Order-to-Case Deviations

The reduction was achieve through standardised workflow design

“FUTUROOT gave us the transparency we needed to make a confident

ERP decision. Instead of opinions, we had the facts in front of us — fast.”

Client Leadership Feedback